Market Recap: January 2025

Market commentary

- The U.S. economy grew at an estimated 2.3% annual rate in the 4th quarter, contributing to a 2.8% rate for 2024.

- Core PCE, the Fed’s preferred inflation measure, remained at 2.8% in December, indicating that further progress is likely needed before additional rate cuts.

- Manufacturing sentiment, as measured by the ISM Manufacturing Index, posted above the neutral rating of 50 for the first time in over two years, at 50.9.

- The Trump administration’s agenda — with substantial changes to immigration and trade policy, including additional tariffs — adds to economic uncertainty.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 2.3% | 3.1% |

| Consumer Confidence | 104.1 | 109.5 |

| Consumer Price Index Y/Y | 2.9% | 2.7% |

| Core PCE (x food & energy) | 2.8% | 2.8% |

| ISM Manufacturing Index | 50.9 | 49.2 |

| Unemployment Rate | 4.1% | 4.2% |

| 2-Year Treasury Yield | 4.20% | 4.24% |

| 10-Year Treasury Yield | 4.54% | 4.57% |

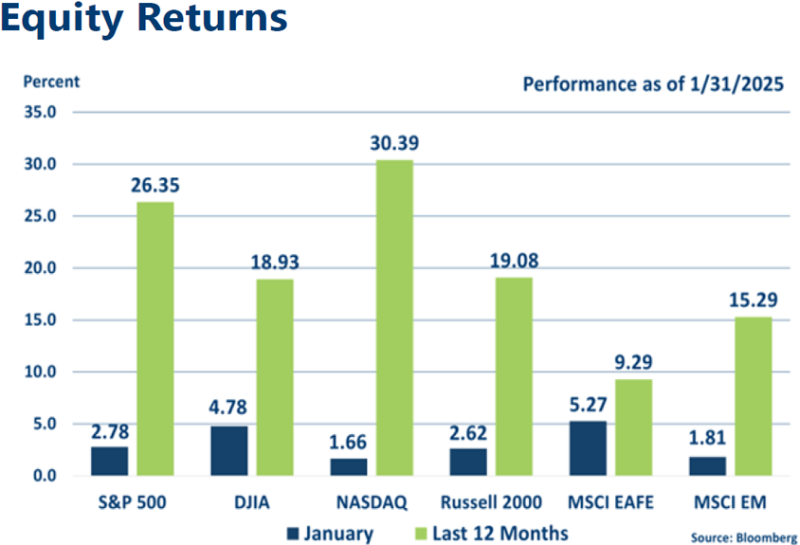

Equities

- After struggling early in January, stocks climbed firmly in the latter half of the month, with the Dow (DJIA) and developed foreign (MSCI EAFE) indices leading returns.

- Following AI-related news, Information Technology stocks fell and were the only sector to perform negatively in January.

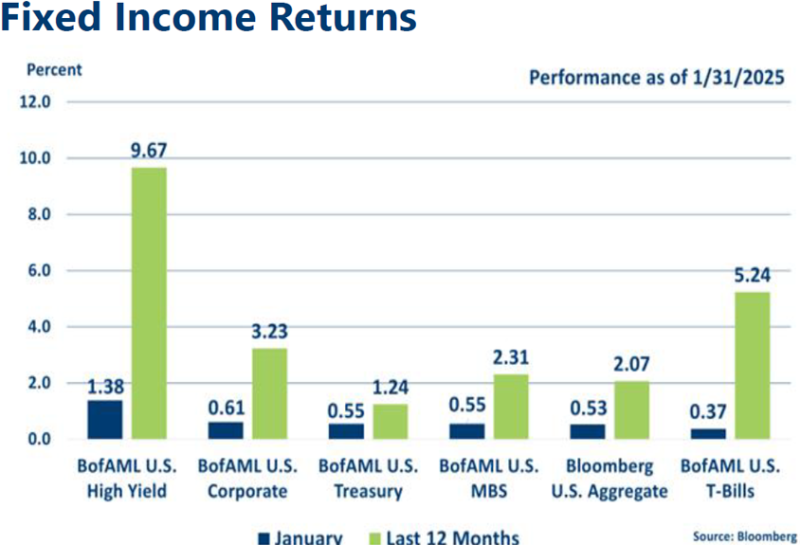

Fixed income

- Treasury yields finished the month at levels near where they began, leading to modest positive performance for bonds.

- Corporate bonds, both investment-grade and high-yield, continue to benefit from a resilient economy and robust equity returns.

Strategic outlook

- Some near-term caution warranted on equities, particularly in high-growth large-cap stocks following a period of significant outperformance; currently favoring small- and mid-cap domestic stocks longer-term.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near-average expected returns projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.