Market Recap: August 2025

Market commentary

- Second-quarter GDP was revised up to 3.3%, driven primarily by stronger business fixed investment. However, expectations for growth in 2025 remain muted.

- Producer prices jumped 3.3% in July, suggesting that businesses are increasingly passing tariff-related costs onto consumers. Meanwhile, consumer prices continue to edge higher, with core Personal Consumption Expenditures (PCE) inflation reaching 2.9%.

- Although housing starts and existing home sales saw a modest rebound in July, the broader trend remains subdued. Builder sentiment has weakened, and affordability continues to be a major headwind amid elevated mortgage rates and home prices.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 3.3% | -0.5% |

| Consumer Confidence | 97.4 | 98.7 |

| Consumer Price Index Y/Y | 2.7% | 2.7% |

| Core PCE (x food & energy) | 2.9% | 2.8% |

| ISM Manufacturing Index | 48.7 | 48.0 |

| Unemployment Rate | 4.2% | 4.2% |

| 2-Year Treasury Yield | 3.62% | 3.96% |

| 10-Year Treasury Yield | 4.23% | 4.38% |

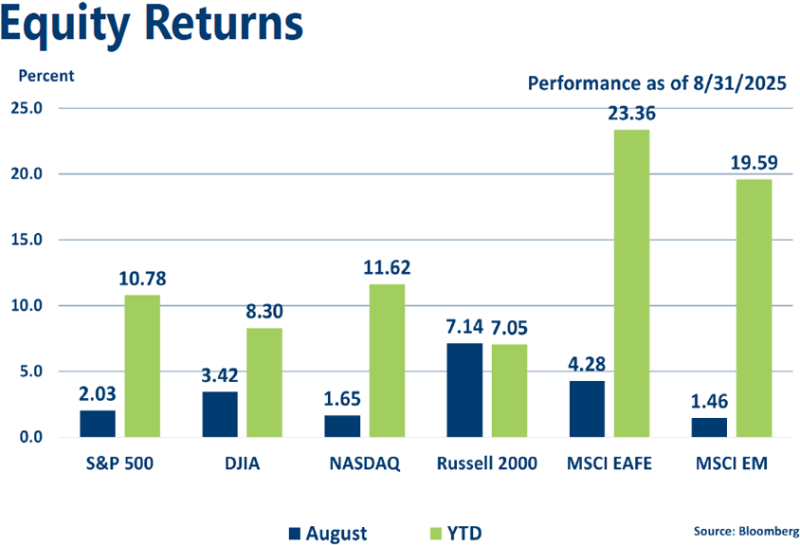

Equities

- Greater clarity around interest rates, combined with resilient corporate earnings, contributed to another strong month for equities.

- With eight of eleven sectors outperforming Information Technology and small-cap stocks showing strong gains, market leadership appears to be broadening.

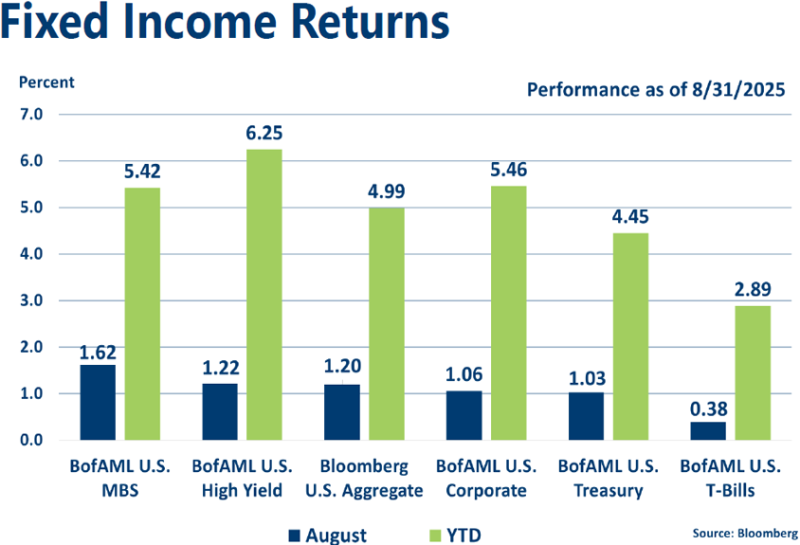

Fixed income

- Powell’s recent comments have reinforced expectations for easing, with markets now pricing a 90% chance of a 25 basis point cut in September and potential for further reductions this year.

- Anticipating Fed action, bond yields fell in August—most notably in shorter maturities—driving strong fixed income returns.

Strategic outlook

- Some caution is warranted on equities in the near term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns are projected for fixed income with the Fed on pause and rates reflective of conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.