UBTgo’s most useful features

With the rise of smartphones and smart strides in technology, mobile banking apps have become more advanced and user-friendly than ever. For example, UBT’s own UBTgo is a 4.9-star rated mobile banking app that was designed to combine functionality, safety, and convenience for the optimal banking-outside-the-bank experience. From (literally) the moment after you download the app, you’re banking like a boss from wherever your busy life takes you. Here, we’ll discuss the features that a new to UBTgo user would find most helpful.

Open a new account

You might think that you’d need to open your account before downloading the app and accessing UBTgo, but not so — you can open an account directly from our app. After a quick download from your device’s app store, you’ll select the I’m ready to open an account! option. From there, you’ll fill in your information and choose the product or products you want to open right from the app. Even better, it takes less than five minutes to complete this process!

Set up Face ID and ensure enhanced security

Enhanced security and a more personalized experience are just a few taps away. The Security section of UBTgo (under More) makes it easy to make your account even safer. Simply select Face ID or Set up your Passcode and follow the prompts to set up.

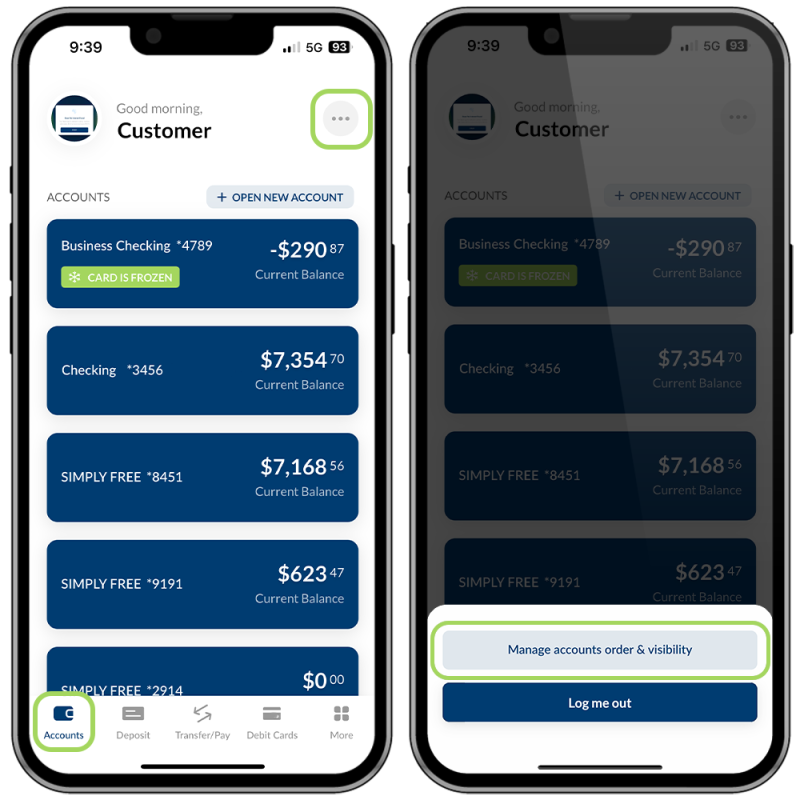

Customize your view

By changing the order in which your accounts are displayed, you’re affording yourself the ultimate in convenience when doing your banking. To adjust how you see your accounts, choose the three dots opposite your name. Then, select Manage accounts order & visibility to make any adjustments. A long tap next to the account enables you to tailor your view to your banking needs.

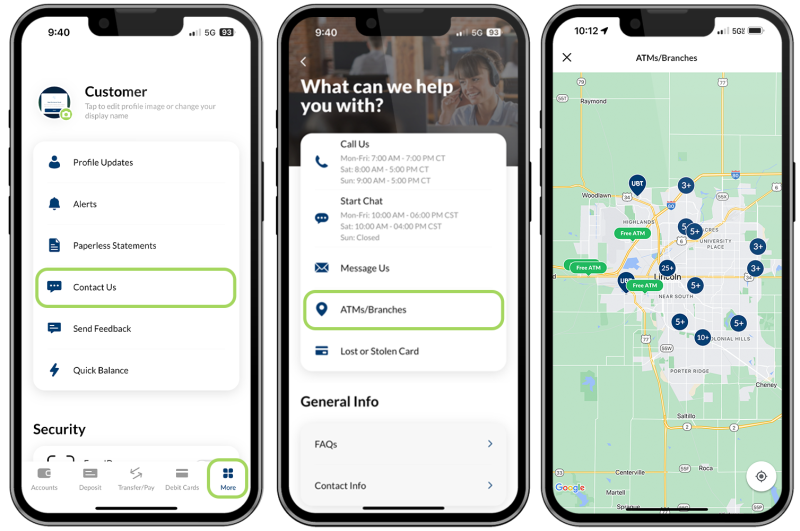

Find (free) ATMs and branches nearby

For the transactions that you are unable to complete on your phone, or if you’re in the mood for a drive or some of our stellar face-to-face customer service, we have a solution. Tucked inside your app, under More, then Contact Us, is a nifty feature to locate ATMs and branches close to you. The whereabouts of your banking needs are a tap away — no advance planning necessary.

Zelle® and BillPay

You can transfer money and pay bills right from the app under the Transfer/Pay section. Paying your bills should be convenient, and you can use UBTgo to add, remove, or edit scheduled payments with ease. You can also set up payments for unexpected expenses or those whose amount fluctuates. If you’ve not yet tried a bill payment service, we recommend giving it a shot — we think you’ll be pleased!

Once you're enrolled in BillPay, you can transfer money to friends and family with Zelle®, a fast, safe, and easy way to send and request money. Funds are sent directly to the recipient’s account in a matter of minutes — all you need is the recipient’s email address or U.S. mobile phone number.1

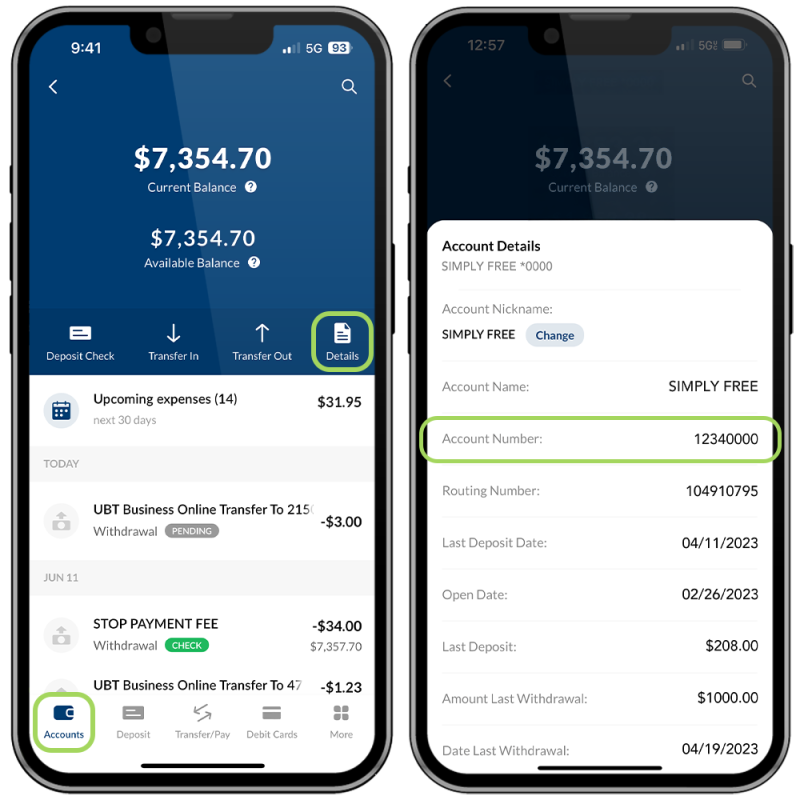

Copy your account number

After you’ve opened your account, you can easily update any recurring payments using your old bank account on your mobile device. Once you’re in the Accounts section, you can choose an account, click Details, and pull up your account information. From there, tap on the account number listed to copy it and paste it where you need to.

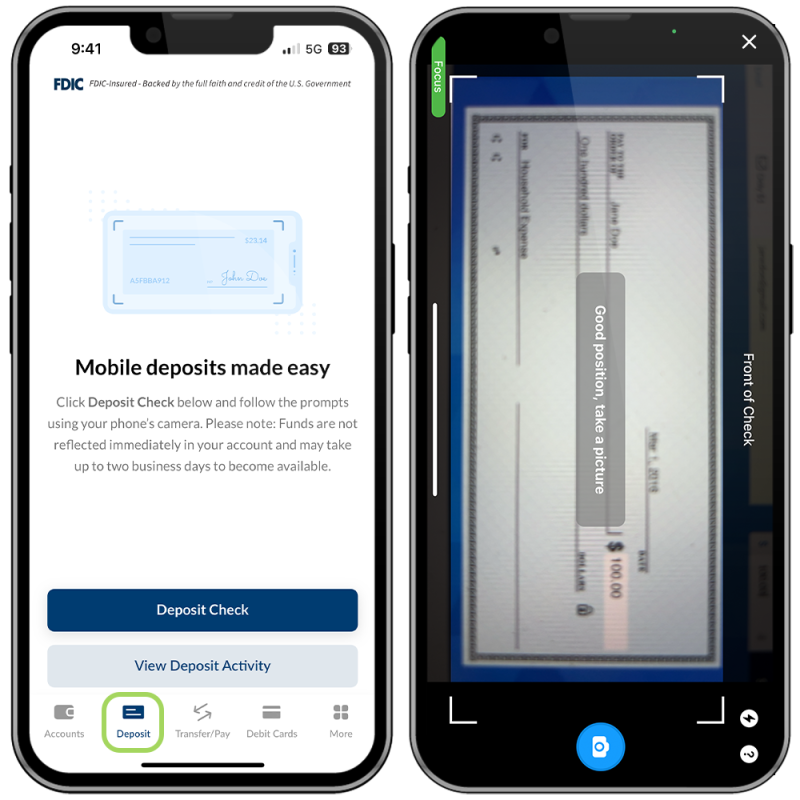

Deposit checks from your phone

With UBTgo’s mobile deposit feature, depositing a check is as simple as taking a picture with your smartphone’s camera — really! A couple of pics and a few quick clicks, and you’ve saved yourself a trip to the branch or ATM.

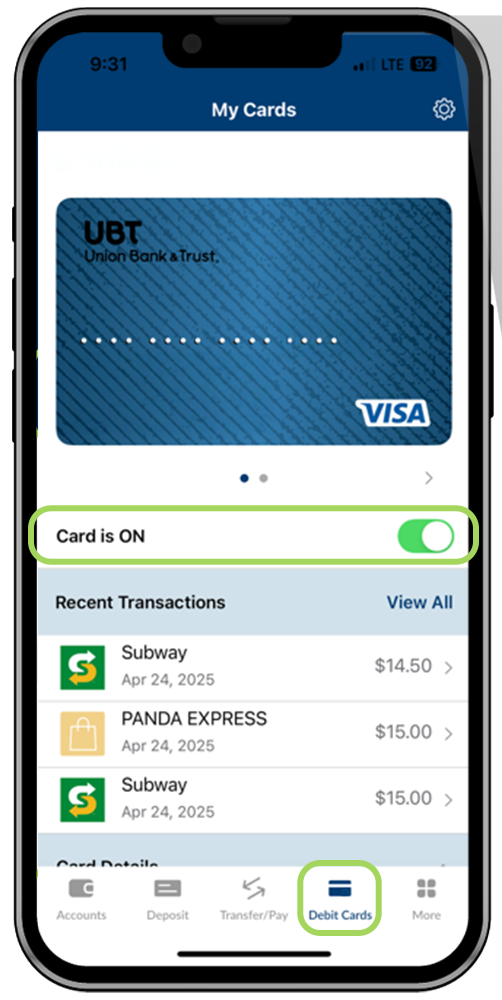

Turn your card on and off

Another convenience/safety feature of UBTgo is the ability to control your debit card. With just a few taps on your mobile device, you can easily turn your card off if it’s lost or stolen. What’s more, you can set limits on your card usage and more.

Customer support

Behind our savvy technology is a team of real people, waiting to help! Connect to Customer Support via chat (in the Contact Us or Messages sections — your choice!) or phone whenever you have a question. Our Customer Support Center is open with extended hours, and if you reach them outside of those hours, they’ll get back to you next day.

Smart features and tools

To recap, UBTgo offers a variety of useful features and tools that make managing your finances more convenient, secure, and accessible. And it’s quick and efficient, because our app was designed with busy folks in mind — after all, while banking is all that we do, we know it’s just a fraction of what you do.

If you’re ready, download UBTgo for Apple® or Android™. As we mentioned, opening an account within UBTgo is easy — and quick! You can complete the account opening process online in less than five minutes, or if you’d rather, visit your nearest UBT branch to get started today.

App Store is a service mark of Apple Inc. Apple and the Apple logo are trademarks of Apple Inc, registered in the U.S. and other countries. Android, Google Play, and the Google Play logo are trademarks of Google Inc. Data charges may apply. Check with your mobile phone carrier for details. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

1 Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle.

Copyright © 2023. All rights reserved.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.