Market Recap: September 2025

Market commentary

- The U.S. economy continues to navigate a complex environment, showing resilience in key areas like consumer spending and technology-driven capital investment.

- Second quarter GDP, buoyed by consumer spending, was revised upward to +3.8%.

- Hiring remains subdued, with termination rates holding steady. Employment conditions are currently stable, but potential government layoffs may lead to a temporary uptick in the October unemployment rate.

- Expected additional monetary easing by the Fed is accompanied by heightened scrutiny of fiscal policy and potential disruptions from a government shutdown.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 3.8% | -0.5% |

| Consumer Confidence | 94.2 | 97.8 |

| Consumer Price Index Y/Y | 2.9% | 2.7% |

| Core PCE (x food & energy) | 2.9% | 2.9% |

| ISM Manufacturing Index | 49.1 | 48.7 |

| Unemployment Rate | 4.3% | 4.2% |

| 2-Year Treasury Yield | 3.61% | 3.62% |

| 10-Year Treasury Yield | 4.15% | 4.23% |

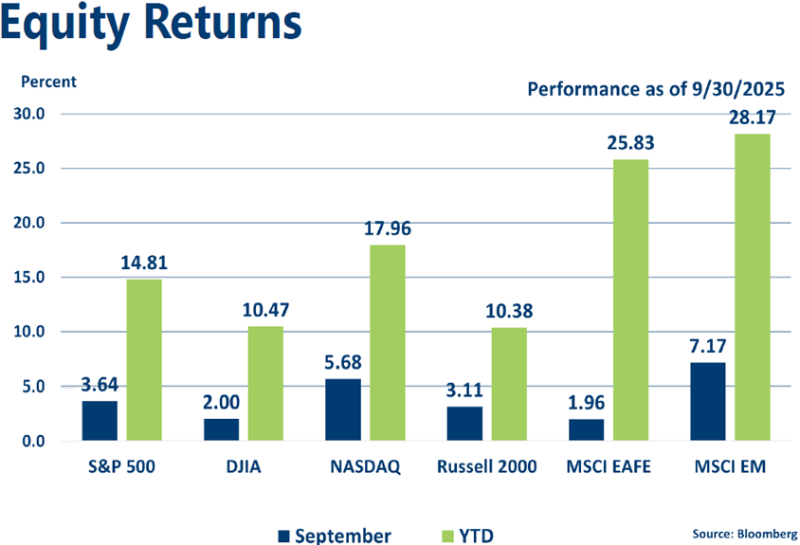

Equities

- The stock market shrugged off its usual September weakness, delivering solid gains on the back of easier monetary policy and strong tech sector performance.

- The Technology and Communication Services sectors drove markets higher, marking five straight monthly gains for the S&P 500 and six for the NASDAQ.

- Emerging Market equities led returns for the month and YTD as the U.S. dollar continued to soften versus EM currencies.

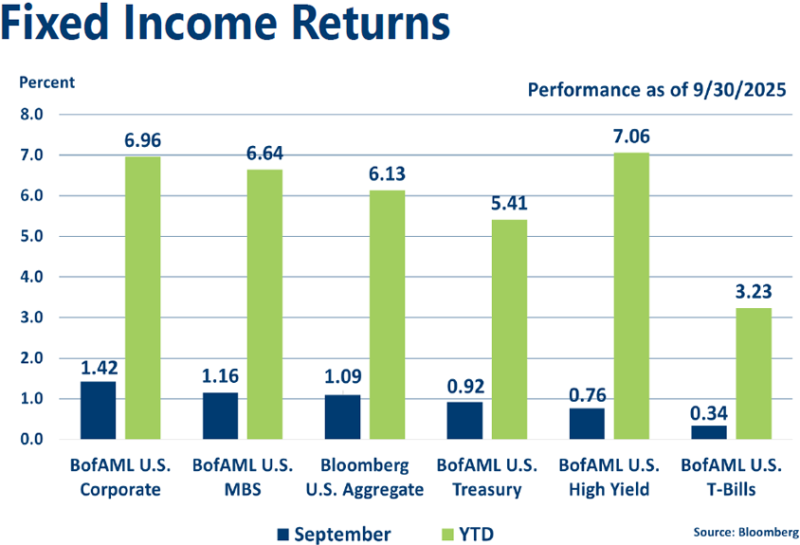

Fixed income

- Bond yields dropped, most notably on longer maturities, as markets both anticipated and reacted to Fed easing, delivering a month of strong fixed-income performance.

- Investors flocked to quality, with treasuries, mortgage-backed securities, and investment-grade corporates leading performance.

Strategic outlook

- Some caution is warranted on equities in the near term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns are projected for fixed income with the Fed on pause and rates reflective of conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.