Market Recap: October 2025

Market commentary

- The ongoing U.S. government shutdown is delaying key economic reports, making current data less timely and increasing uncertainty about near-term conditions.

- Consumer spending has remained resilient despite multiple shocks, including tariffs, a weakening labor market, and rising delinquencies.

- Inflation showed signs of easing in September, with CPI slightly below expectations and rent inflation decelerating sharply.

- Evidence points to a soft patch in growth for Q4, driven by weak hiring and the shutdown. While risks are rising, structural supports and policy cushions (such as tax refunds and Fed rate cuts) may help stabilize conditions heading into 2026.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 3.8% | 3.8% |

| Consumer Confidence | 94.6 | 95.6 |

| Consumer Price Index Y/Y | 3.0% | 2.9% |

| Core PCE (x food & energy) | 2.9% | 2.9% |

| ISM Manufacturing Index | 48.7 | 49.1 |

| Unemployment Rate | 4.3% | 4.3% |

| 2-Year Treasury Yield | 3.58% | 3.61% |

| 10-Year Treasury Yield | 4.08% | 4.15% |

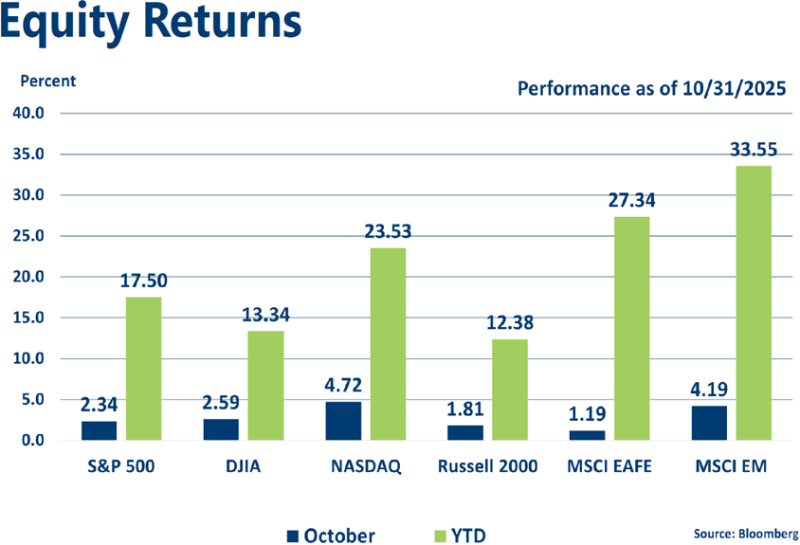

Equities

- U.S. equities extended their rally in October, marking six straight months of gains for the S&P 500 — the longest streak in four years — while the NASDAQ posted its seventh consecutive monthly rise, its best run since 2018.

- Strong earnings and another Fed rate cut fueled optimism, while the ongoing government shutdown has barely dented investor sentiment.

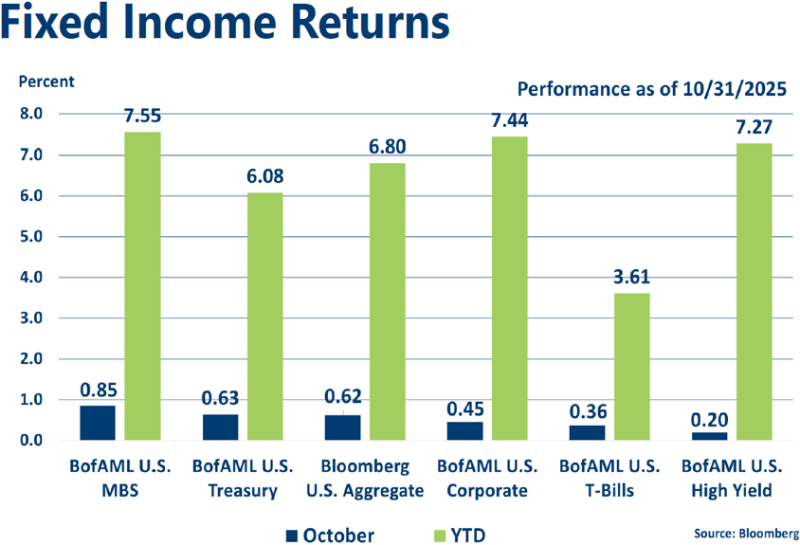

Fixed income

- On October 29, the Fed cut rates by 0.25% — its second reduction in two months — and is expected to keep easing into 2026 to support growth.

- October bond returns reflected a steady rate environment, with 2-year Treasury yields slipping to 3.58% from 3.61% and 10-year yields easing to 4.08% from 4.15%.

Strategic outlook

- Some caution is warranted on equities in the near term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns are projected for fixed income with the Fed on pause and rates reflective of conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.