Answers to all your HSA questions

Health savings accounts (Member FDIC) remain a valuable tool in healthcare financial planning, enabling eligible plan participants to use pre-tax dollars for qualified medical expenses and helping you manage your healthcare costs. Knowing the who, what, where, when, why, and how of health savings accounts (commonly known as HSAs) can offer you more clarity and guidance — and your friends at Omnify are here to help sort it all out.

Who is eligible for an HSA?

If you meet all the criteria listed below and neither you nor your spouse have currently elected a medical flexible spending account (or FSA), you are eligible to open and contribute to an HSA:

- You are covered by a qualified high-deductible health plan (HDHP) on the first day of a given month.

- You are not covered by another non-HDHP, such as a health plan sponsored by your spouse’s employer.

- You are not enrolled in Medicare or TriCare.

- You have not received VA benefits at any time during the preceding three months; if you are a veteran with a service-connected disability, this exclusion does not apply.

- You are not claimed as a dependent on another individual’s tax return.

Note: Other exceptions and restrictions may apply. Please consult a tax or legal professional to discuss your personal circumstances.

What can I use my HSA funds for?

HSA funds can be used for qualified medical, dental, and vision expenses. Some qualified medical expenses include doctor visits, prescription medications, dental care, vision care, and even over-the-counter medications. Additionally, HSA funds can cover medical equipment like crutches, bandages, and diagnostic devices. You can find a more comprehensive list on the HSA Store website. It’s important to keep receipts and documentation for all HSA expenses to ensure they meet IRS guidelines and to avoid potential tax penalties.

Where do my HSA funds go at the end of the year?

Fortunately, if you’re able to save them, they stay put!

Unlike FSAs, the funds in an HSA do not expire at the end of the year. Any unused money in your HSA automatically rolls over to the next year, which allows you to grow your account and plan for future medical expenses. This benefit makes HSAs a long-term savings option for healthcare costs.

Fun fact: If you’re fortunate enough not to need your HSA funds for medical expenses throughout the year, they can be invested — which conveniently leads us to the next question.

When can a participant invest their HSA funds?

An investment HSA* from Omnify is a valuable tool that helps you save for rising healthcare costs while boosting your retirement savings at the same time. Opening an investment HSA gives you access to reputable mutual fund families selected by the experts in UBT’s Trust department. Once you reach the $500 minimum investment threshold, you have access to 40 investment options, including 11 lifecycle funds, 25 individual funds, and four target funds.

Why have an HSA?

Contributing to an HSA offers you triple tax savings. You can contribute on a pretax basis through payroll deduction, reducing your taxable income; the funds grow tax-free; and when funds are used for qualified medical, dental, and vision expenses, the expenses are tax-free. HSA funds are portable too, meaning you can take them with you if you change jobs.

How do I gain access to my funds?

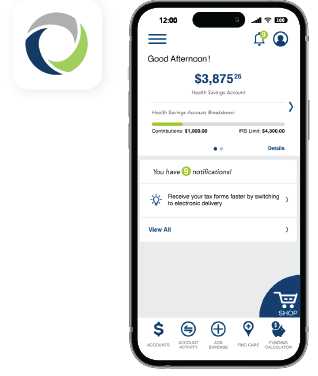

With Omnify, we make it easy to gain access to funds when needed. We have three different options that you can use when you need to access your HSA money. You can use your Omnify debit card, pay bills through free online BillPay, or reimburse yourself for out-of-pocket healthcare purchases online or through the mobile app.

Putting it all together

The best thing about having an HSA with Omnify is that you’re never alone. Our team is committed to helping you understand your account and use it to its fullest advantage. Reach out any time with your questions about how best to maximize your HSA — we’re here to help!

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.