Local legend: How LG Searcey found success in football and finance

225 wins. 25 winning seasons. Three national championships. Coach Tom Osborne’s Cornhuskers are one of the most successful teams in sports history. Some attribute the program’s success to Coach’s trademark I-formation offense. Some, his relentless focus on details like strength, conditioning, and quality nutrition. Others chalk it up to the sheer talent and passion of the players he recruited.

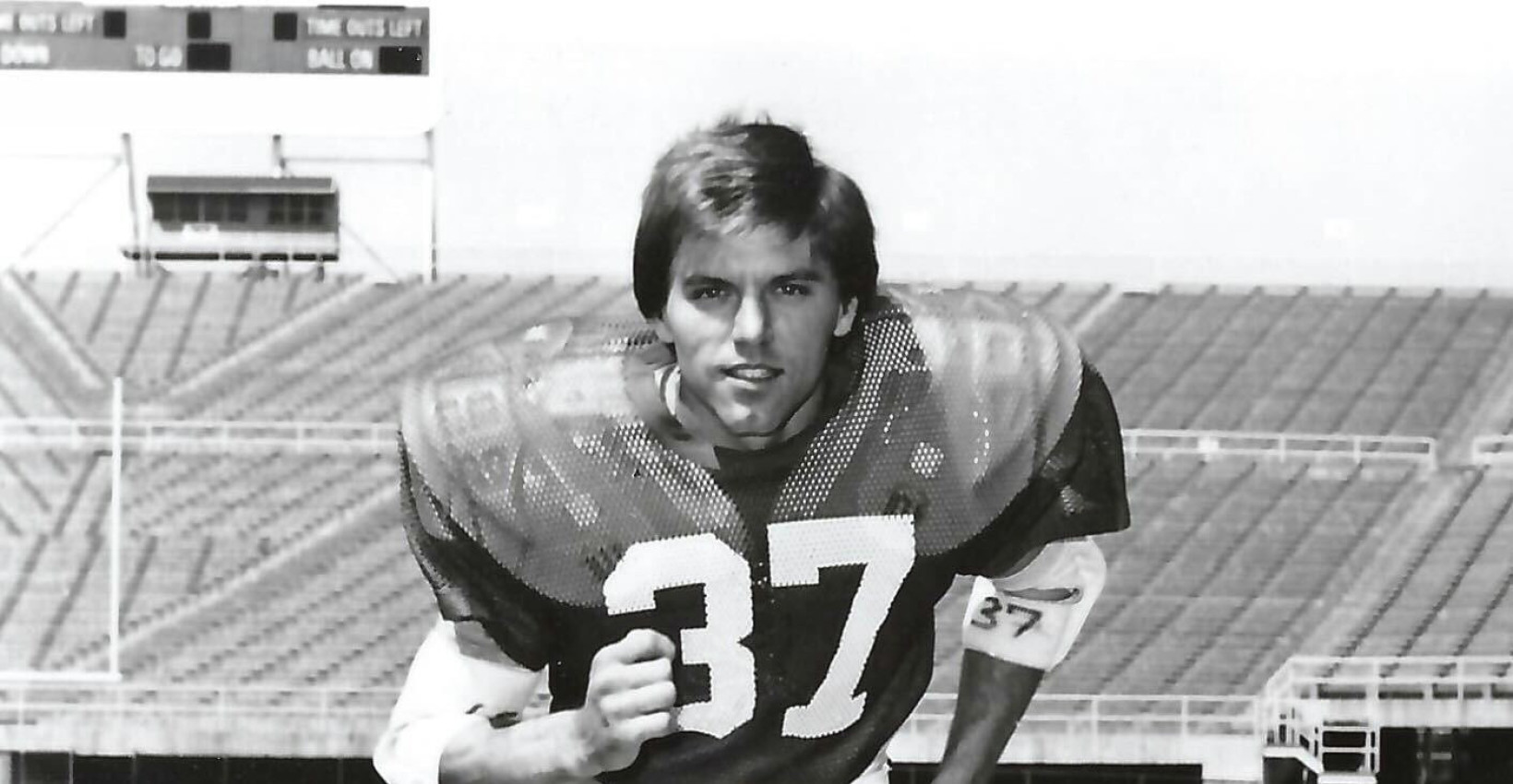

But if you played for Ozzy, as his players and fans affectionately call him, you knew it was about more than play calling and talent (though those certainly offered an edge). “It was about the fundamentals — the little things,” says LG Searcey, a Wymore, Nebraska-raised farm kid turned Husker Football defensive back from 1977 to 1981. “It was about doing them right — every single day.”

It’s a philosophy he took with him to the meticulous and fast-paced world of commercial banking and finance, where LG has made a name for himself and Lincoln’s Union Bank & Trust for his team’s ability to help businesses of all kinds get off the ground, grow, and evolve.

The early years

Wymore is about an hour’s drive south of Lincoln. It’s a straight shot down highway 77 through Cortland, Pickrell, then Beatrice. Having grown up on a small grain and pig farm with two older brothers, LG was no stranger to hard work and roughhousing. For friends and family, it was no surprise that in 1976 — the same year Foghat’s “Slow Ride” topped the charts — LG made the Nebraska High School Football Class C-1 All-State defensive team. Shortly after, he signed on to play for the Huskers.

LG playing in a Husker football game

Ask LG how it felt to live out the dream of nearly every high school football player in the Midwest, and he shifts in his seat. He glances down at his hands, folded neatly in his lap. “You know,” he pauses, speaking carefully. “I got to do a lot of things and go a lot of places small-town kids from Nebraska don’t get to.” He’s more comfortable talking about the lessons he learned from Coach Osborne and his staff. But even these aren’t as flashy as you might expect.

Team unity above everything. Mean and do what you say. Own your mistakes, and credit your teammates for your success. Don’t make excuses. Just get it done. Maximize your God-given ability.

LG knew they were lessons worth learning and, after his four-year stint as a Cornhusker, there was even more to learn: He joined Coach Osborne’s staff as a graduate assistant. “I wanted to learn to lead a team to work really hard and handle both success and failure,” he says, noting Coach’s steadfast composure (on and off the field) through wins, losses, and adversity.

After graduation, LG landed in a management training program at a bank in downtown Lincoln. His knack for strategy and relationship-building caught leadership’s attention, and even though LG’s heart was still on the field, he got to work, building relationships with business leaders.

Gaining momentum

LG participating in a community fundraiser

Take Interstate 80 out of Lincoln, and no matter which way you’re heading, eventually you’ll see an iconic water tower on the horizon. To the east — just outside Gretna — a jet-black water tank with Go Big Red painted down its base. To the west, an orb-shaped tank resembling a hot air balloon marking the entrance into York. These are just two of the hundreds of water tanks J.R. Stelzer Co. has sandblasted and painted over the last 50 years.

Back in the ’80s, when owner Jim Stelzer found himself in touch with LG, his business had grown to a critical point: It was expanding into more and more industrial jobs and in need of specialized equipment — sandblasting pods, semitrucks and trailers, and large air compressors. Jim knew a loan the size of the one he needed might be a long shot.

“When you’re a new business, sometimes the only thing there is to loan against is your character,” Jim chuckles, remembering how difficult it was to find a lender who would go to bat for him. LG was different. “He appreciated my character, and he respected me as a businessman rather than treating me like a young guy with big ideas,” says Jim. The influx of capital provided what Jim needed to scale operations across the state and beyond, from Minnesota’s Twin Cities down to Texas. In transitioning to the next generation of ownership (Jim’s sons), the business has expanded even further, more than doubling in volume.

In the mid-1990s, LG made the move to Union Bank & Trust (then the fifth largest bank in Nebraska with locations across the state and a growing reputation for innovation and service). Jim didn’t think twice about making the switch along with him.

“Now we’re able to self-finance, and that’s pretty cool,” Jim says, but he’ll never forget the man who championed him when he needed it most. “Anyone will loan you money if you don’t need it,” Jim says. “When you really need it, that’s when a relationship starts.”

The big things and the little things

By 2000, UBT had established itself as one of Nebraska’s leading banks. That year, it surpassed $1 billion in assets, executed a number of small but noteworthy acquisitions, and was appointed to manage the state’s newly minted 529 plan (the College Savings Plan of Nebraska). When, in that same year, the market leader was purchased by one of the world’s largest banking institutions, UBT leaned hard into its values: Faith. Family. Work. “In that order; every time,” says LG. “It’s a culture of inspiring leadership, teamwork, grit, doing the right thing.”

A year later, his hard work landed LG a deserved promotion to Senior Vice President of Business Loans and Financing. The player had become the coach. Fittingly, LG’s office for a time had overlooked a familiar site — one that gnawed at him. “I could see the stadium from the windows,” he says. “I’d look down at the field and think, ‘Why am I here and not there? I should be down there coaching players. Not in a suit and tie.’”

LG sits back in his chair. He’s tall; a gray suit lays carefully across his broad shoulders. His silver hair is parted neatly. His voice is deep and warm — the kind of guy you’ve known your whole life from the moment you’ve met him.

“Life doesn’t go like you plan it,” he says, a little quieter than the sentence before it. His eyes flicker with hard-earned wisdom. “Sometimes, rather than wishing for what isn’t, you take advantage of what is. I finally realized: I am coaching. I’m coaching this team of lenders when they’re struggling and when they’re doing well, and I’m coaching them to do the little things — every day — that make their clients’ lives and businesses better.”

LG and his wife Becky

Indeed, LG was the perfect fit to lead the bank’s lending team. He dove headfirst into building it, growing relationships with clients and their businesses the UBT way. One of those clients was Con Muilenburg, whose relationship with UBT began in 1981 when he secured a loan to buy his first grocery store in Lincoln, called Leon’s. A gourmet grocer, Leon’s found a niche among Nebraskans as a purveyor of top-tier meats and produce. Its reputation grew, as did the relationship between LG and Con.

“LG hasn’t just been my lender, he’s been my friend and confidante,” says Con, noting his wisdom, guidance, and expertise. “He knows me and my portfolio better than anyone. I can go to him with anything, and he’ll help me to the maximum degree. He’s as solid as they get.”

At its height, Con’s grocery enterprise had 17 locations and more than 500 employees. Today, he’s moved on to other successful business endeavors, but he’ll never forget his humble beginnings. “When I didn’t have much, they took a chance on me. It means everything to have your bank believe in you.”

From mainstays to early adopters

UBT’s diverse and expansive Commercial Lending team is held to a consistently high standard—one that echoes to the highest ranks of the bank’s leadership and back through the people it serves. LG’s approach draws inspiration from the teams that shaped his youth and early career. He’s focused on putting the right people in the right spots and letting them run —and valuing those people and investing in their knowledge and growth over time so they can become deeply immersed in the industries and businesses they serve.

“Because of his leadership and his integrity, each of us is able to represent a given customer to the different committees we work with in the bank, and we get to be advocates for those customers,” explains Todd Furasek, UBT’s Vice President of Business Loans and Financing and a 17-year member of the team. “We get to represent what works well for the bank, we get to represent what works well for the customer and, in the middle, we get to add meaningful value to both.”

The team is adaptable and responsive—capable of providing both broad knowledge and expertise, as well as incredible depth when it comes to specific niche markets. At the same time, the team is adept at sizing up and addressing diverse challenges and opportunities across growth cycles and industries—from early-stage startups to rapidly scaling ventures and multi-million-dollar growth projects.

UBT's Commerical Lending team

Many, like Lincoln-based TELCOR, have seen evolutions through all those stages. Founded in the mid-’90s, TELCOR provides operational and revenue cycle management software for labs and healthcare businesses (namely hospitals, nursing homes, physicians’ offices, pharmacology businesses, and clinics). It’s a unique industry and business model, and one that has benefitted from a higher standard of specialized service from the Lending and Treasury Management teams at UBT over their decades-long relationship.

“Most banks won’t take risks on software businesses,” says Deb Larson, one of the company’s original founders, noting that its lack of physical assets was an even more significant challenge at the time that she and her co-founders were getting the company going. Not the case with UBT, which won TELCOR’s business by understanding the nuances of technology and software in a time when other lenders just didn’t quite get it. Even in the early days of TELCOR, the Commercial Lending team dug into structuring creative lending solutions that allowed the business to manage its balance sheet amid growth and scale. “UBT was willing to take a risk on us,” says Deb, who relies on the bank for a range of treasury management services that streamline clerical tasks so TELCOR can save time and labor resources while also mitigating fraud and liability. “Every time we’ve needed the team at UBT, they’ve been there for us.”

In addition to serving a diverse spectrum of businesses, the UBT team includes lenders with specialized focus in key areas: equipment leasing and financing, church lending, Greek house financing, healthcare and medical, cities and municipalities, agricultural loans, warehouse lending, and fleet financing. Lenders work closely with businesses of all types and sizes to understand the nuances, dig into the details, and find creative solutions. When they get stuck, they resource each other and LG — drawing on a massive collective pool of knowledge and experience. Many become trusted advisors to the business leaders they serve as their needs evolve into money management services and operational support.

Lenders also leverage UBT’s extensive Treasury Management team to align customers’ needs with practical and trusted solutions. Collectively, the team is a chorus of familiar fundamentals: problem-solving, consistency, humility, and dedication. It’s why businesses in industries that range from construction to consumer-packaged goods and from software as a service to healthcare count on UBT to help them launch, scale, survive, and thrive.

“Growing and mentoring this team has been one of the greatest joys of my life,” says LG. The team speaks as highly of him. There’s an air of confidence that is both individual and collective.

It’s a dynamic group of individuals with diverse skills and talents committed to doing right by businesses starting and expanding across the Midwest and beyond — the big things and the small things — every single day.

The Searcey family, 2024

The heart of a city

In the fall of 2023, UBT opened the doors to Union Bank Place — a 12-story building designed by the firm of renowned Chinese American architect I.M. Pei in the heart of downtown Lincoln. The building’s storied history is one of capital and commerce — nearly half a century as a hub for banking. From the corner of 13th & O Street, the building was actually designed to mimic the distinct outline of the state’s geographic borders — including its panhandle. Its lobby is carefully adorned with beautiful finishes. Its glass-walled conference rooms and sleek stonework shingle into a modern yet cozy coffee bar and lounge area. There are spaces to gather; spaces to work; spaces to seek input and feedback and collaborate on projects large and small. Outside, the sign where the outline of a maroon and yellow horse-drawn stagecoach hung over pedestrians’ heads for decades has been replaced by UBT’s bold blue lettering.

A few blocks away, the stadium roars. Rain or shine, win or lose, it roars. Faith. Family. Work. In that order. Every time.

“These values resonate with the people who live in our state because we share them,” says LG. He sits back in his chair and folds his hands. When LG came aboard in 1995, UBT provided $80 million in loans to businesses and homeowners. Last year, the bank provided $1.8 billion to local businesses alone. “These values resonate because they’re good,” says LG. “And we relish in sharing them.”

Some might call it a legacy — a dynasty even. But not LG. For him, it’s just doing the little things right — and getting better, every single day.

Loan products subject to credit approval.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.