Smarter in September: Our virtual series recap

In September, UBT’s Journey team hosted another run of Smarter in September series, our popular how-to series designed to educate and enrich on a wide variety of topics. Virtual attendees tuned in every Tuesday at 2 p.m. for our experts’ presentations and often some great Q&A about meal planning without breaking the bank, preparing to re-enroll in Medicare, making the most of education savings for your favorite students, and next steps when rightsizing your home (or buying that perfect vacation getaway). We recorded the segments for YouTube history, so whether you missed one or all of the sessions the first time around, or are coming back for a second look, you’ll find that these fun and informative segments are time well spent. So, settle in, read the recaps, and prepare to push play — it’s time to get smarter!

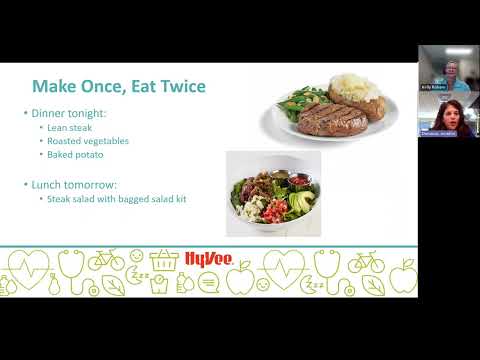

Smarter Shopping and Meal Prep: Getting the most bang for your grocery buck

Featuring Jennifer Dunavan, MS, RD, LMNT — Hy-Vee Registered Dietitian

Not one, but two local experts joined us in this segment to share best practices for dollar-wise grocery shopping and meal prep tips for minimum fuss and maximum nutrition. Our friend Jennifer Dunavan was joined by her colleague Hannah Boyd, the newest addition to Hy-Vee’s team of healthy eating gurus. From tips for stretching your food dollars and staying on budget when shopping, to nutrition basics and a visit to the world of MyPlate for balanced eating, to ideas for making the most of food prep tools and shortcut products, plus quick meal inspiration and recipe tips, this powerhouse session covers it all. Have a look!

Smarter About Education Expenses: Saving for higher education while saving on taxes

Featuring Donna Crownover, Vice President and College Savings Plan Relationship Manager – Union Bank &Trust

Time flies by, and our favorite greats and grands will be college-age before we know it. In this helpful session, we obtained incredible insight from a seasoned pro as Donna discussed the importance and value of saving for college, the benefits of NEST Education Savings Plans, plan investment options,* and important action steps to consider. Her comprehensive presentation also covered the importance of plan flexibility, complete with examples, as well as the significant tax benefits. We know attendees benefitted greatly from this session — and their future scholars will, too!

Note: We are very sorry, but the video of this presentation is unavailable. We invite you to contact UBT’s College Saving Plan experts directly with specific questions or for plan information. You may reach them Monday through Friday from 7 a.m. – 7 p.m. CT at 888.993.3746 or by visiting nest529.com.

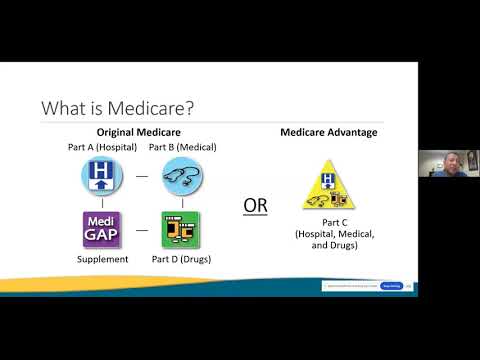

Smarter About Medicare: What you need to know about open enrollment

Featuring Jonathan Burlison, Director of the Nebraska SHIP/SMP Division – Nebraska Department of Insurance

In this helpful session, our presenter dispensed wide-ranging information and additional resources in preparation for the Medicare open enrollment, or annual election period, which begins October 15. He took virtual attendees through an interesting high-level overview of Medicare before launching into a detailed explanation of plan parts, supplements, and Medicare Advantage plans. Attendees learned about the “three Cs” of Medicare as well as highlights of the Inflation Reduction Act, or I.R.A. Lastly, Jonathan gave a comprehensive demonstration of the medicare.gov interactive website. It’s definitely worth a look!

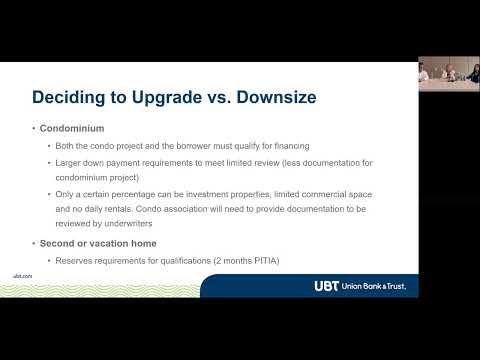

Smarter About Rightsizing: Finding and funding your perfect fit

Featuring Tami Wolford, Assistant Vice President and Home Loan Officer (NMLS ID #422466), and Mariana Hunt, Assistant Vice President and Home Loan Officer (NMLS ID #826767), both from Union Bank & Trust, and Doug Hanna, Realtor©, Home Real Estate

For the 73 million baby boomers who will be retiring by 2030, called the silver tsunami by the real estate industry, rightsizing could very well be part of the picture. This powerhouse segment takes attendees through several downsizing and upgrading scenarios — including top reasons for rightsizing and types of dwellings — to offering valuable financing tips rightsizing don’ts. Our presenters did an incredible job of equipping attendees with the tools needed to make informed decisions for their next season. If you or someone you know are contemplating a change, you won’t want to miss this segment!

We hope you enjoy each week’s totally watch-worthy segments. Join us in January to hit reset with our Tune-Up Tuesday series. In the meantime, visit the Journey page to learn more about Journey happenings.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.