Market Recap: July 2025

Market commentary

- Beneath volatile headlines, growth remains modest. Q2 GDP rebounded to 3.0% but was largely driven by trade and inventory distortions. Final domestic demand was up just 1.3% in the first half of 2025.

- Private sector job growth is slowing, with July payrolls rising just 73,000 — well below consensus. Structural labor constraints continue to limit supply and keep unemployment low.

- Tariff-related price pressures remain contained, with core PCE inflation steady around 2.8%.

- Manufacturing is beginning to show signs of recovery after a prolonged downturn, whereas the housing sector continues to face headwinds from elevated interest rates and persistent labor shortages.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 3.0% | -0.5% |

| Consumer Confidence | 97.2 | 95.2 |

| Consumer Price Index Y/Y | 2.7% | 2.4% |

| Core PCE (x food & energy) | 2.8% | 2.7% |

| ISM Manufacturing Index | 48.0 | 49.0 |

| Unemployment Rate | 4.2% | 4.1% |

| 2-Year Treasury Yield | 3.96% | 3.72% |

| 10-Year Treasury Yield | 4.38% | 4.23% |

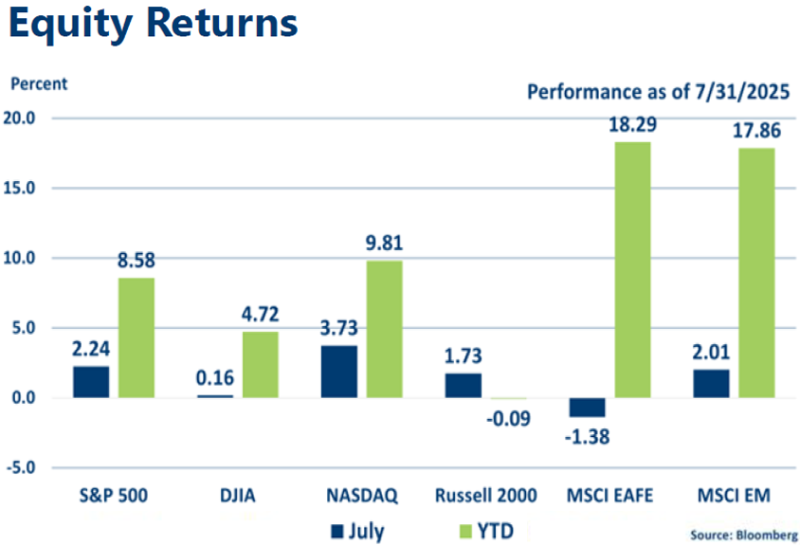

Equities

- Equities rallied in July, fueled by strong corporate earnings, positive trade negotiations, and helpful economic data.

- Margin debt — where investors borrow against holdings to buy more stock — has now bested levels seen in 2000 and 2007.

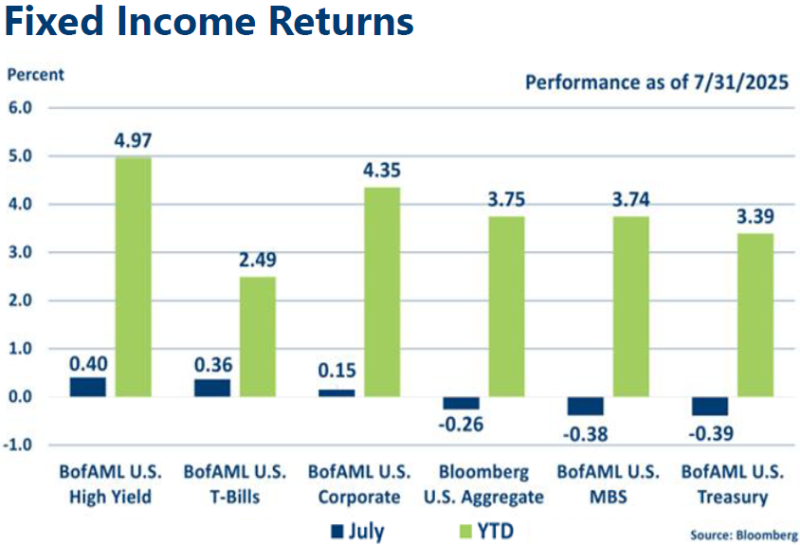

Fixed income

- The Fed kept rates steady at its July 30 meeting. Chair Powell cited inflation risks tied to trade policy as a key reason.

- Bond yields edged higher in July, with the 10-year U.S. Treasury closing at 4.38%, up from 4.23% the previous month.

Strategic outlook

- Some caution is warranted on equities in the near term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns are projected for fixed income with the Fed on pause and rates reflective of conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.