Market Recap: April 2025

Market commentary

- The extent of the tariffs announced in early April exceeded market expectations, resulting in a volatile month.

- With imports surging ahead of upcoming tariffs and an unexpected decrease in government spending, GDP declined by 0.3% in the first quarter, marking its first drop since the pandemic.

- Despite the GDP decline, employment, industrial production, and other indicators show no signs that domestic production decreased in the first quarter.

- Both Consumer Sentiment and Consumer Confidence declined in April, falling for the 4th and 5th straight months, respectively.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | -0.3% | 2.3% |

| Consumer Confidence | 86.0 | 93.9 |

| Consumer Price Index Y/Y | 2.4% | 2.8% |

| Core PCE (x food & energy) | 2.6% | 2.8% |

| ISM Manufacturing Index | 48.7 | 49.0 |

| Unemployment Rate | 4.2% | 4.1% |

| 2-Year Treasury Yield | 3.61% | 3.89% |

| 10-Year Treasury Yield | 4.16% | 4.21% |

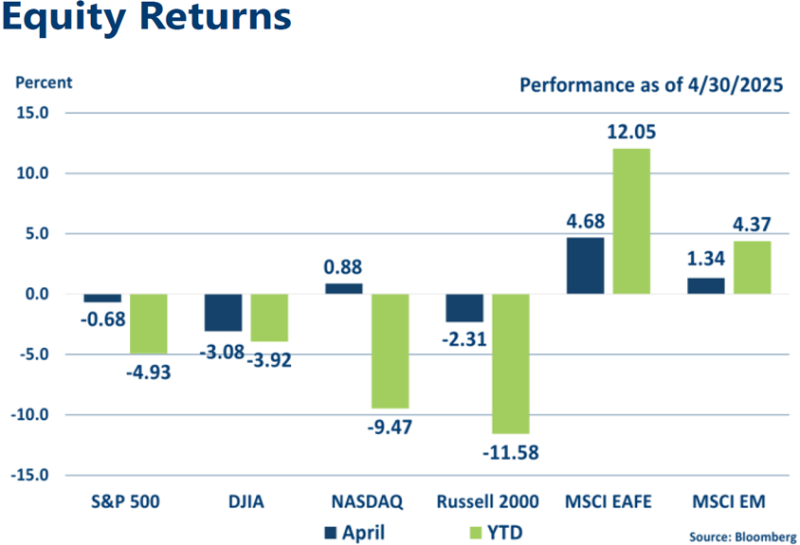

Equities

- Most major U.S. stock indices ended lower for the third straight month. However, these losses did not capture the most volatile month in five years, during which the S&P 500 was down nearly 14% at one point from its March 31 close.

- International equities again outperformed domestic stocks, posting positive returns for both the month and year-to-date.

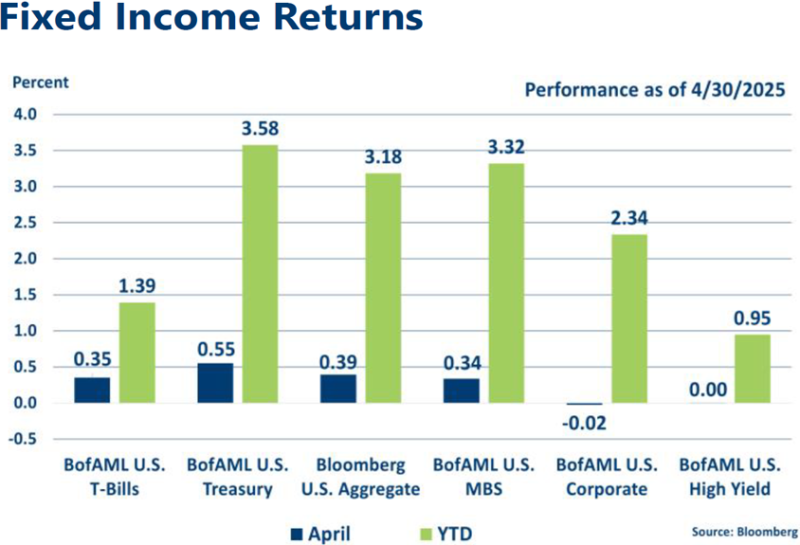

Fixed income

- After the tariff announcement, the 10-year U.S. Treasury yield dipped below 4%, then surged to nearly 4.6% a week later, before eventually settling at slightly lower levels.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns projected for fixed income with the Fed on pause and rates reflective of conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.