Five key factors that could alter markets in 2026

While the stock market has experienced one of the strongest three-year stretches in history, it’s natural to wonder how long this will continue. On one hand, corporate profits remain strong and the economy is still growing, conditions that have historically supported continued expansion. On the other hand, stock valuations are high, and historically elevated market multiples have led to more muted forward returns. Let’s review five key factors that may offer clues about the market’s next direction, allowing you to monitor the markets like a pro in 2026.

#1: Federal Reserve policy decisions

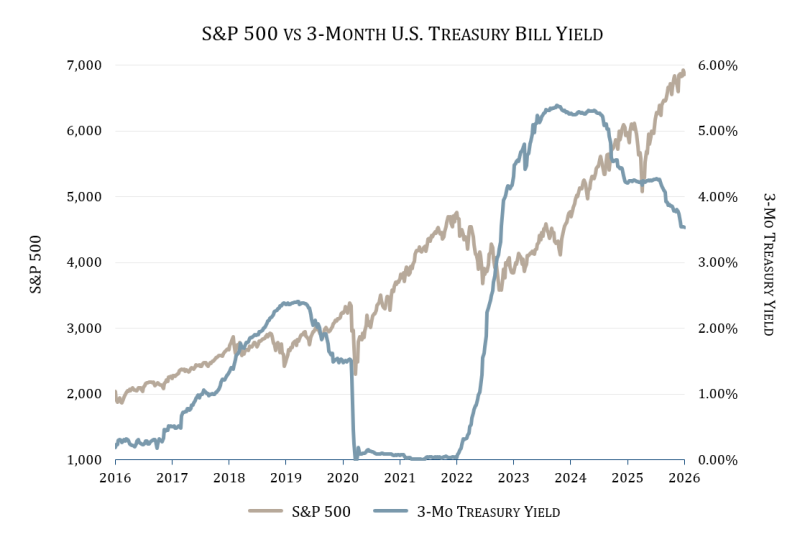

Last year, we highlighted that the Federal Reserve’s interest rate policy would be an important factor to watch, and it remains a key driver in 2026. In 2025, fewer interest rate cuts came through than many had expected, keeping borrowing costs higher for much of the year. While this didn’t noticeably slow the market in 2025, history shows that when interest rates are relatively high, bonds tend to become more appealing than stocks, which can put pressure on stock market returns.

Why does it matter?

Higher short-term interest rates would continue to boost returns on cash, while higher long-term rates would increase borrowing costs for both households and businesses, which could put pressure on their finances. If the Federal Reserve decides to lower rates, returns on idle cash would fall, but investors might be willing to take on more risk. It’s also important to remember that long-term rates don’t always move in lockstep with the Fed’s benchmark rate, so changes in policy can sometimes produce unexpected effects across the economy and markets.

What should I watch?

Continue to pay close attention to Federal Open Market Committee (FOMC) meetings and public statements, as these provide insight into the Federal Reserve’s next policy moves. Another key development to follow is leadership at the Federal Reserve. Fed Chair Jerome Powell’s term as Chair is set to end in May, at which point President Donald Trump is expected to nominate a new Fed Chair. Markets will be watching closely, as changes in leadership can influence how aggressively, or cautiously, the Fed approaches future interest rate decisions.

#2: The employment picture

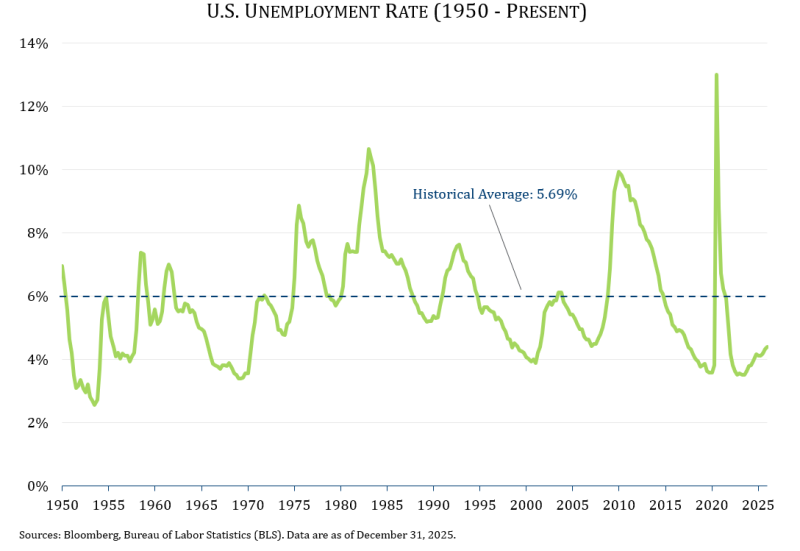

Employment trends are becoming an increasingly important focus for the Federal Reserve as the job market shows signs of cooling. While initial unemployment claims have remained relatively steady, the unemployment rate has risen to 4.4%, up from 4.0% at the start of 2025 and a full percentage point higher since the low in April 2023. Historically, this type of rise has only occurred in conjunction with a recession, making the current environment unusual. Overall, the job market appears mixed, with signs of both resilience and weakening.

Why does it matter?

The job market plays a major role in shaping how consumers feel about the economy, how much they spend, and how well they can manage debt. With employment data sending mixed signals, some consumers may grow less confident in the economic outlook and pull back on spending. At the same time, continued resilience in the job market suggests that both household and corporate finances may be in better shape than headline concerns imply.

What should I watch?

To track changes in the job market, pay attention to the monthly U.S. jobs report, which shows how many new jobs were added, as well as weekly unemployment claims, which provide an early signal of layoffs and job losses. Together, these reports help to show whether employment conditions are strengthening or weakening. Another important trend to watch — one we touched on last year — is the impact of artificial intelligence on employment. While widespread job displacement from AI is unlikely in the near term, companies adopting AI to improve efficiency may slow hiring or eliminate specific roles that can be automated, resulting in leaner workforces and lower employment.

#3: The One Big Beautiful Bill Act (OBBBA)

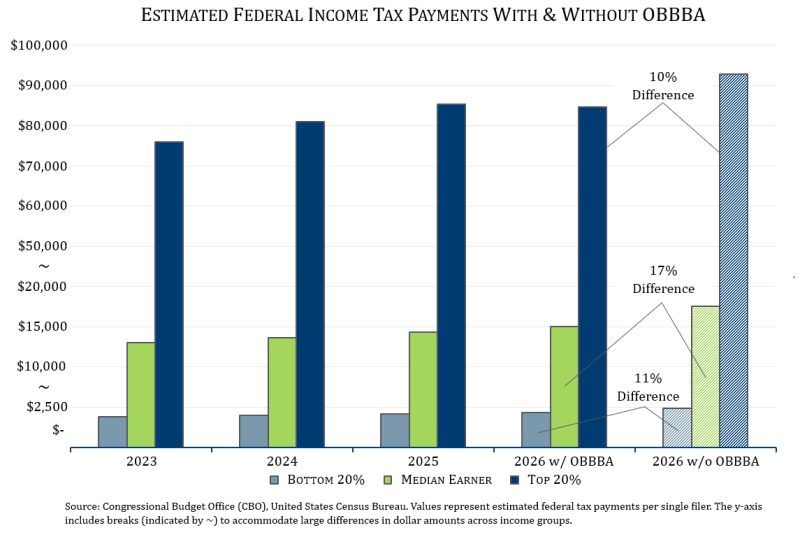

The landmark OBBBA bill, signed into law this summer, includes a wide range of measures expected to affect taxes, government spending, and the federal budget in 2026. Among its provisions are an extension of the 2017 Tax Cuts and Jobs Act; new deductions for tips, overtime pay, and auto loans; updates to child-related tax credits and the creation of new child-focused savings accounts; and changes to Medicaid and SNAP work requirements. The bill also raises the debt ceiling and increases spending on border enforcement and defense.

Why does it matter?

Corporate profits are expected to remain strong into 2026, and most consumers should see tangible benefits from the new law. At the same time, increased government spending could add to the federal deficit and may eventually contribute to higher prices for everyday goods. Strong market performance in the second half of 2025 suggests investors may have already anticipated much of the bill’s impact. While analysts are bullish on profits from increased spending in 2026, the actual realization of these expectations still needs to be confirmed.

What should I watch?

To gauge the impact of the OBBBA, there are a few key indicators to follow. The bond market, particularly the 10-year Treasury yield, could signal investor concern about the federal deficit, which the bill is expected to add trillions of dollars to over the next decade. In the spring, some groups will begin receiving new tax deductions and credits, which could support increased consumer spending. Additionally, positive company earnings reports and management commentary can signal consumer strength.

#4: Catch up or catch down?

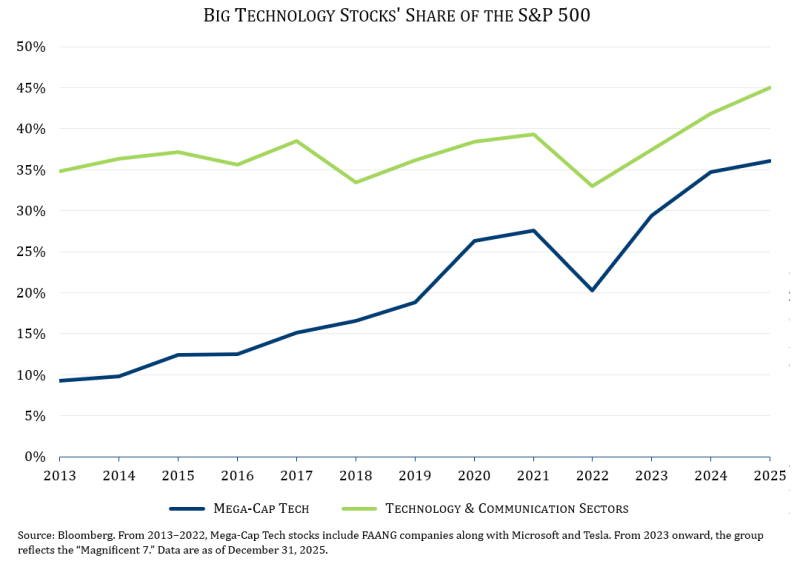

Over the past several years, technology stocks, especially those included in the so-called “Magnificent 7,” have significantly outperformed the broader stock market and the average company in the S&P 500. While that outperformance continued in 2025, it was less pronounced than in prior years. Looking ahead in 2026, a midterm election year, market volatility is likely to pick up amid political uncertainty, especially given how calm markets were to end the year. Historically, during periods of higher volatility, defensive sectors such as healthcare and consumer staples have held up better, and as a result, other lagging sectors may experience a period of “catch-up” performance. After several years of heavy investment, companies tied to AI may need to demonstrate clear returns on that spending to justify further gains. If those returns fail to materialize, some AI-related stocks could see a period of “catch-down” relative to the rest of the market, which could put pressure on tech-heavy indices due to the sheer size of the “Magnificent 7” stocks.

Why does it matter?

For investors who are not heavily concentrated in Big Tech or the “Magnificent 7,” a broader market rally would be a positive development. If gains continue to spread beyond a handful of large technology companies to lagging sectors and smaller businesses, a well-diversified mix of U.S. stocks could deliver solid returns this year. A similar dynamic played out in 2025, when international stocks staged a “catch-up” rally of their own, reinforcing the value of diversification and supporting more balanced portfolio outcomes.

What should I watch?

As the new year begins, one useful signal to watch is market volatility. The VIX, often called the market’s “fear gauge,” tends to rise when investors become nervous. When that happens, riskier and more speculative stocks often struggle, while steadier areas of the market tend to hold up better. Continue to keep an eye on market gains spreading beyond the largest tech companies. When more stocks participate in a rally, it’s generally a positive sign for overall market strength. Finally, keep an eye on smaller U.S. companies. Many high-quality smaller businesses improved their earnings last year but saw their stock prices lag. If investors begin to recognize that improvement, those stocks could see meaningful gains.

#5: International stock outperformance

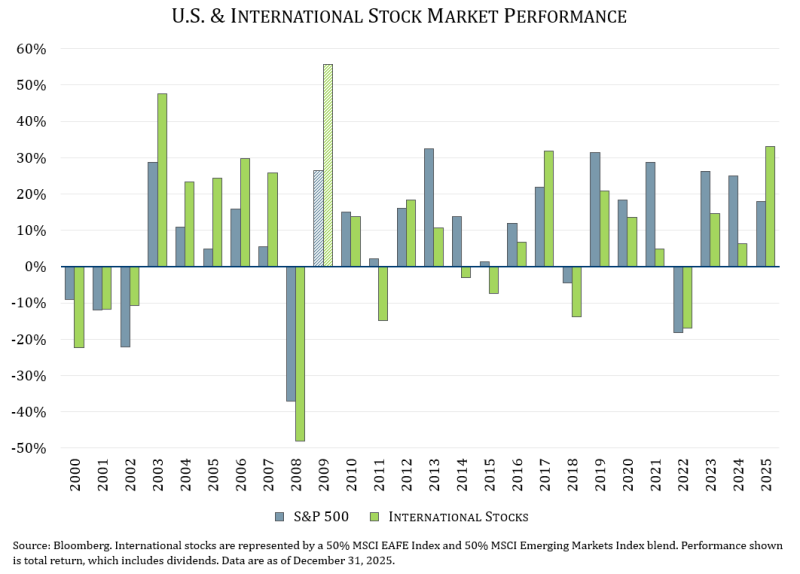

International stocks performed strongly last year, posting their largest outperformance relative to U.S. stocks in over 15 years. Part of that strength came from a weaker U.S. dollar, which tends to boost returns on overseas investments for U.S. investors. However, many international markets also benefited from increased government spending, lower interest rates, and policy changes that placed a greater emphasis on economic growth. Together, these shifts created a more supportive environment for companies outside the United States.

Why does it matter?

Just as in the U.S., where gains spreading beyond a few dominant sectors would benefit investors, stronger performance in international stocks also matters because it rewards diversification. When returns come from many regions rather than a single market, portfolios tend to be more resilient and less dependent on any one economic outcome. In 2025, several international stock markets reached new multi-decade highs and nearly all major global markets posted gains. If this broader strength continues, it would provide an important tailwind for diversified portfolios, helping smooth returns and reduce reliance on U.S. markets alone.

What should I watch?

When watching international stocks, the U.S. dollar remains an important signal. A weaker dollar tends to help international investments, because foreign denominated earnings translate into more dollars and overseas assets become relatively more valuable. Valuations are another key factor to monitor. U.S. stocks currently trade at higher prices relative to earnings than most international markets, which means overseas stocks have more room for gains if global growth continues. If the dollar stays weak and valuation gaps begin to close, international stocks may well continue to outperform U.S. markets.

We’re here to help you navigate it all

2026 is shaping up to be a dynamic year for the markets, with robust trailing returns and an ever-changing economic landscape. Staying informed about factors such as these can help investors make strategic and prudent decisions. Diversifying your portfolio and consulting with financial advisors will be key to navigating the complexities of the market.

If you have any questions or would like to talk through your options, feel free to reach out. Here’s to a successful investment journey in 2026!

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.